The global pulp and paper industry continues its steady evolution, adapting to sustainability demands, digital transformation, and shifting market dynamics. This comprehensive analysis examines current market conditions, technological innovations, and strategic opportunities shaping the industry’s future.

The pulp and paper industry represents a $379.58 billion global market in 2024, projected to reach $551.15 billion by 2034. Major manufacturers face mounting pressure to optimize production efficiency while meeting environmental regulations and embracing digital technologies. Modern solutions for machinery integration and production line optimization have become critical success factors for maintaining competitive advantage.

TL;DR: Key Industry Insights

- Global market valued at $379-423 billion in 2024, growing at 1.7-3.8% CAGR through 2035

- Asia-Pacific leads with 39% market share; China dominates production and consumption

- Industry accounts for 2% of global industrial CO2 emissions and 6% of industrial energy use

- Digital transformation offers $4-6 billion value opportunity with 5-10% throughput gains

- The packaging segment drives growth, while the graphic paper declines due to digitalization

- Environmental regulations accelerate sustainable production technology adoption

- Production optimization and automation are critical for competitive manufacturing

Industry Overview and Market Dynamics

The contemporary paper manufacturing landscape reflects fundamental shifts in consumer behavior, environmental consciousness, and technological capabilities. Market dynamics reveal both challenges and opportunities as manufacturers navigate changing demands while investing in sustainable production methods.

Market Size and Regional Analysis

The global paper market demonstrates resilience despite digital disruption, with packaging applications driving continued growth. Asia-Pacific maintains market leadership, accounting for nearly 40% of global production capacity. China consumes approximately 87.8 kg of paper per person, well above the global average of 53.6 kg, while maintaining its position as both the largest producer and consumer globally.

North American markets show maturation characteristics with steady but modest growth rates of around 1.0% annually. The region houses major industry players, including International Paper, Georgia-Pacific Corporation, and WestRock, who focus increasingly on sustainable packaging solutions and production efficiency improvements.

European markets emphasize innovation and environmental leadership, with countries like Finland and Sweden pioneering advanced biorefinery technologies and circular economy initiatives. These developments influence global industry standards and drive technology adoption across other regions.

Product Segments and Applications

Packaging applications dominate current market dynamics, representing over 53% of total paper production. The segment benefits from e-commerce expansion and sustainable packaging mandates that favor paper-based solutions over plastic alternatives. Corrugated board manufacturing experiences particularly strong growth as online retail continues expanding globally.

Tissue paper production maintains steady growth driven by hygiene awareness and urbanization trends, especially in developing markets. Healthcare applications and premium tissue products create additional value opportunities for manufacturers investing in specialized production capabilities.

Conversely, graphic paper faces continued decline as digital media adoption accelerates. Publishers, corporations, and educational institutions increasingly favor electronic alternatives, forcing manufacturers to pivot production capacity toward packaging and specialty applications.

Pulp and Paper Industry Challenges and Strategic Solutions

The modern pulp and paper industry confronts unprecedented challenges requiring innovative approaches to production, sustainability, and technological integration. Manufacturers must balance traditional operational excellence with emerging demands for environmental responsibility and digital sophistication.

Environmental Sustainability Pressures

Environmental impact represents the industry’s most pressing challenge, with manufacturers facing increasing regulatory scrutiny and consumer pressure for sustainable practices. The industry accounts for approximately 2% of global industrial CO2 emissions, while consuming 6% of global industrial energy and requiring massive water resources for production processes.

Water usage presents particular challenges, with paper production requiring approximately 10 liters of water per sheet. Advanced water recycling systems and closed-loop processes have become essential for regulatory compliance and cost management. Modern mills can reuse water up to 10 times throughout manufacturing processes, significantly reducing fresh water consumption and environmental impact.

Deforestation concerns continue to pressure the industry, as wood products account for approximately 14% of global forest loss. Sustainable forestry certification through FSC and PEFC programs provides pathways for responsible sourcing, while alternative fiber development reduces dependence on virgin wood materials.

Carbon emissions reduction initiatives focus on renewable energy adoption, biomass utilization, and process optimization. Leading manufacturers implement combined heat and power systems using production waste, achieving significant reductions in fossil fuel consumption while maintaining operational efficiency.

Production Efficiency Demands

Energy intensity challenges manufacturers operating in competitive commodity markets, where cost optimization directly impacts profitability. The industry ranks fourth globally in industrial energy consumption, necessitating continuous efficiency improvements and technology investments.

Raw material cost volatility affects production planning and pricing strategies, particularly for wood pulp and recycled fiber inputs. Manufacturers implement advanced inventory management systems and supplier diversification strategies to mitigate supply chain risks and maintain stable production costs.

Labor shortage and workforce aging create operational vulnerabilities as experienced operators retire without adequate replacement pipelines. Production line setup optimization and automation technologies help manufacturers address these challenges while maintaining production quality and safety standards.

Quality consistency requirements from packaging and tissue applications demand precise process control and monitoring systems. Advanced sensors, data analytics, and automated adjustment mechanisms ensure product specifications meet customer expectations across diverse market segments.

Digital Transformation Imperatives

Industry 4.0 adoption lags behind other manufacturing sectors, creating significant opportunities for competitive advantage through strategic technology implementation. Digital transformation offers potential value of $4-6 billion globally, with successful implementations achieving 5-10% throughput gains and up to 5 percentage points in yield improvements.

Predictive maintenance systems reduce unplanned downtime through continuous equipment monitoring and failure prediction algorithms. IoT sensors throughout production lines collect real-time performance data, enabling proactive maintenance scheduling and equipment optimization.

Process optimization technologies integrate multiple production variables to maximize efficiency while maintaining quality standards. Advanced control systems automatically adjust parameters based on real-time conditions, reducing waste and improving consistency across production runs.

Supply chain digitalization connects suppliers, logistics providers, and customers through integrated platforms that optimize material flow and delivery scheduling. These systems particularly benefit manufacturers operating multiple facilities or serving diverse geographic markets.

Technology Trends Shaping the Future

Technological innovation drives industry transformation as manufacturers seek competitive advantages through automation, sustainability, and digital integration. The pulp and paper industry increasingly adopts advanced technologies to address operational challenges while meeting evolving market demands.

Automation and Smart Manufacturing

Modern packaging machinery incorporates sophisticated automation technologies that enhance production speed, consistency, and safety. Robotic systems handle material movement, quality inspection, and packaging operations with precision exceeding manual processes while reducing labor requirements.

Smart mill concepts integrate sensors, analytics, and control systems across entire production facilities. These interconnected systems optimize energy usage, raw material consumption, and production scheduling based on real-time demand and operational conditions.

Predictive maintenance technologies utilize machine learning algorithms to analyze equipment performance data and predict potential failures before they occur. This approach reduces unplanned downtime by 20-30% while extending equipment life through optimized maintenance scheduling.

Quality control automation employs vision systems and spectroscopic analysis to inspect products continuously throughout production processes. Automated rejection systems remove defective products while adjusting process parameters to prevent recurring quality issues.

Sustainable Production Technologies

Alternative fiber processing technologies enable manufacturers to utilize agricultural waste, bamboo, hemp, and other non-wood materials for paper production. These innovations reduce deforestation pressure while creating new supply chain opportunities in agricultural regions.

Biorefinery integration transforms traditional pulp mills into multi-product facilities that produce paper, biofuels, biochemicals, and biomaterials from the same raw materials. This approach improves economic efficiency while supporting circular economy principles.

Energy recovery systems capture waste heat from production processes for electricity generation and facility heating. Combined heat and power installations can provide 60-80% of mill energy requirements while reducing carbon emissions significantly.

Water treatment innovations include membrane bioreactors, advanced oxidation processes, and zero liquid discharge systems that eliminate wastewater while recovering valuable materials for reuse in production processes.

Digital Integration Solutions

Industrial IoT platforms connect production equipment, quality systems, and business applications through unified data architectures. These integrated systems provide real-time visibility across operations while enabling advanced analytics and optimization algorithms.

Cloud-based analytics platforms process vast quantities of production data to identify optimization opportunities and predict market trends. Machine learning algorithms continuously improve recommendations as they analyze more operational data.

Converting machinery increasingly incorporates digital twins that simulate equipment performance and optimize settings before implementation in actual production environments. This technology reduces trial-and-error approaches while improving conversion efficiency.

Blockchain applications ensure supply chain transparency and sustainability verification throughout the paper production process. These systems track fiber sources, processing methods, and environmental impact metrics from forest to finished product.

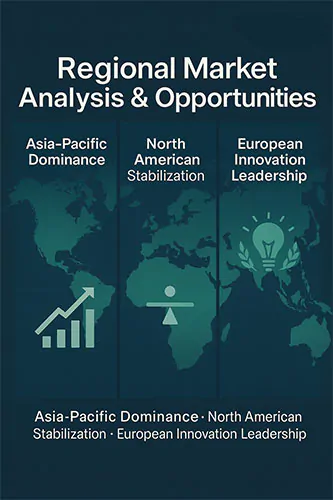

Regional Market Analysis and Opportunities

Asia-Pacific Dominance

China’s market leadership stems from massive domestic consumption and export capabilities supported by significant manufacturing investments. The country operates some of the world’s largest and most modern paper mills, with continued capacity expansion planned through 2030.

Southeast Asian markets, including Indonesia, Vietnam, and Thailand, experience rapid growth driven by urbanization, economic development, and packaging demand from expanding consumer goods industries. These markets offer attractive opportunities for technology suppliers and equipment manufacturers.

India represents a high-growth opportunity with per capita paper consumption well below global averages but rising rapidly as the economy develops. Government initiatives supporting packaging industry growth and sustainable manufacturing create favorable conditions for industry expansion.

North American Stabilization

Market maturity in the United States and Canada emphasizes operational optimization over capacity expansion. Manufacturers focus on efficiency improvements, automation adoption, and sustainable production technologies to maintain competitiveness against lower-cost international producers.

Recycling infrastructure in North America enables high recovery rates for corrugated packaging and newsprint, supporting circular economy objectives while reducing raw material costs. Approximately 96.5% of corrugated boxes are recycled according to EPA data.

Investment priorities center on digital transformation, energy efficiency, and specialty product development that command premium pricing in competitive markets. Advanced automation and process control systems help offset higher labor costs compared to developing markets.

European Innovation Leadership

European manufacturers lead in environmental technology development and sustainable production practices, driven by stringent regulatory requirements and consumer preferences for eco-friendly products. Innovation clusters in Nordic countries drive global technology advancement.

Circular economy initiatives integrate paper production with other industries to minimize waste and maximize resource utilization. Bioeconomy strategies position paper mills as platforms for renewable chemical and material production.

Research and development investments focus on breakthrough technologies, including nanocellulose applications, bio-based chemicals, and carbon capture systems. These innovations often find global application as environmental standards tighten worldwide.

| Regional Market Comparison | Market Size (2024) | Growth Rate (CAGR) | Key Characteristics |

|---|---|---|---|

| Asia-Pacific | $142.6 billion | 4.2% | Manufacturing hub, high growth |

| North America | $63.4 billion | 1.0% | Mature market, efficiency focus |

| Europe | $89.2 billion | 1.5% | Innovation leader, sustainability |

| Latin America | $22.9 billion | 2.8% | Emerging opportunities |

| Technology Solutions Impact | Implementation Benefits | Typical ROI Timeline | Primary Applications |

|---|---|---|---|

| Predictive Maintenance | 20-30% downtime reduction | 12-18 months | Equipment optimization |

| Process Automation | 5-10% throughput increase | 18-24 months | Production efficiency |

| Digital Analytics | 15-25% energy savings | 6-12 months | Resource optimization |

| Quality Control Systems | 30-50% defect reduction | 9-15 months | Product consistency |

Future Outlook and Strategic Considerations

The pulp and paper industry trajectory through 2035 reflects continued adaptation to sustainability imperatives, technological advancement, and evolving market demands. Successful manufacturers will integrate environmental responsibility with operational excellence and digital capabilities.

Market growth projections indicate steady expansion driven primarily by packaging applications and emerging economy development. However, competitive dynamics increasingly favor manufacturers with advanced automation, sustainable practices, and flexible production capabilities.

Technology adoption acceleration becomes essential for maintaining a competitive position as digital natives enter decision-making roles and sustainability requirements intensify. Early adopters of Industry 4.0 technologies demonstrate measurable advantages in efficiency, quality, and environmental performance.

Investment strategies must balance immediate operational improvements with long-term transformation initiatives. Successful manufacturers develop phased implementation plans that deliver incremental value while building capabilities for future market requirements.

Conclusion

The pulp and paper industry stands at a critical transformation point where traditional manufacturing excellence must integrate with digital innovation and environmental stewardship. Market opportunities abound for manufacturers embracing advanced technologies and sustainable practices while optimizing production efficiency. Strategic investments in automation, process optimization, and digital integration will determine competitive success in an evolving global marketplace.

Frequently Asked Questions

Environmental sustainability pressures, digital transformation requirements, energy costs, and labor shortages represent the primary challenges. Manufacturers must balance production efficiency with carbon emission reduction while adopting automation technologies.

Digital technologies deliver 5-10% throughput improvements and significant cost reductions through predictive maintenance, process optimization, and quality control automation. The industry has $4-6 billion in potential digital value waiting to be captured.

Asia-Pacific dominates with 39% market share, led by China as the largest producer and consumer. North America and Europe maintain significant positions but focus on efficiency and sustainability rather than capacity expansion.

Sustainability drives regulatory compliance, customer requirements, and competitive differentiation. The industry accounts for 2% of global industrial CO2 emissions, making carbon reduction essential for long-term viability and market access.